Unveiling The Black Tax: A Deep Dive into 150 Years of Racial Exploitation in America

By Rev. Dr. Philippe SHOCK Matthews

(Black Trauma and Mental Health Specialist | Prompt Eng | GPT Dev | Research Scientist | Africana Phenomenologist)

The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America is a meticulously researched book that examines the impact of tax policies on racial wealth gaps and offers a new perspective on tax policy debates, making it a timely exploration of racial injustices in taxation.

The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America

“The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America” delves into the deep-rooted racial injustices perpetuated by the U.S. tax system over the past century and a half. The author meticulously chronicles how state and local tax policies have not only widened the wealth gap between Black and white Americans but have also systematically disadvantaged African American homeowners since the Reconstruction era. For instance, the book exposes how Black homeowners have been unfairly taxed compared to their white counterparts, shedding light on the historical and ongoing exploitation within the American tax system.

Furthermore, the book highlights the courageous efforts of Black Americans who fought against discriminatory tax practices and second-class citizenship while contributing significantly to the nation’s tax revenues. By examining the predatory system of racial capitalism that has significantly impacted Black communities, the author calls for reparations as a means of rectifying the long-standing injustices faced by African Americans. Through a detailed analysis of historical events and contemporary issues, “The Black Tax” aims to challenge existing narratives surrounding homeownership, wealth accumulation, and the true cost of democracy for Black individuals in America. The author’s approach not only sheds light on the systemic exploitation of Black homeowners but also underscores the urgent need for policy changes to address the persistent racial disparities embedded within the U.S. tax system.

Moreover, the book serves as a critical resource for readers seeking a comprehensive understanding of how tax policies have been used as tools of oppression and dispossession throughout American history. By offering a fresh perspective on tax policy debates and unveiling the hidden mechanisms that perpetuate racial inequality, “The Black Tax” contributes significantly to ongoing conversations about racial justice, reparations, and economic empowerment within marginalized communities. It challenges readers to confront the uncomfortable truths surrounding the economic exploitation of Black Americans and advocates for a more equitable and inclusive tax system that upholds the principles of fairness and justice for all citizens.

Introduction

“The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America” is a groundbreaking work that meticulously examines the deep-rooted racial injustices embedded in the American tax system. Through a detailed exploration of historical events and contemporary issues, the author reveals how state and local tax policies have been instrumental in widening the wealth gap between Black and white Americans. For example, the book chronicles the experiences of Black homeowners who have been subjected to discriminatory tax practices since the Reconstruction era, highlighting the disparities that persist to this day.

The author’s credentials play a vital role in establishing the credibility of the book. As a renowned expert in the field of racial inequality and taxation, they bring a wealth of knowledge and experience to the narrative, offering readers a well-researched and insightful perspective on the subject matter. By weaving together narratives of resilience and resistance from Black Americans who have navigated a tax system designed to exploit them, the book not only educates but also inspires readers to critically reflect on the intersection of race, wealth, and taxation in America.

Product Details

The book titled “The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America” is a significant addition to the discourse on racial injustices and economic disparities in the United States. Authored by Andrew W. Kahrl, the book delves into the intricate details of how the tax system has perpetuated racial inequality over the past century and a half. Through meticulous research and compelling narratives, the author sheds light on the exploitation and dispossession faced by Black Americans, challenging long-standing notions about taxation and wealth accumulation.

Published by the University of Chicago Press, this groundbreaking book is set to be released on April 24, 2024. With a file size of 5391 KB and a print length of 451 pages, the book is available for a discounted price of $29.92, down from the regular price of $34.99, offering readers a 14% discount on valuable insights into the historical and contemporary implications of tax policies on racial wealth gaps. The ASIN for the e-book version is B0CMPKV7NJ, making this essential read easily accessible to a wide audience interested in understanding the profound impact of taxation on Black communities in America.

Description

Praised by notable figures, “The Black Tax” provides a poignant examination of racial injustices perpetuated through tax policies. The book meticulously explores the impact of tax policies on the racial wealth gap, offering a fresh perspective on ongoing debates around tax policy and racial disparities. Through detailed analysis, the author contributes to a deeper understanding of historical and contemporary issues related to economic inequality and systemic racism.

An example illustrating the book’s significance is its documentation of the systematic exploitation of Black homeowners, showcasing how tax policies have contributed to the wealth gap between Black and white communities.

Features

“The Black Tax” offers a plethora of features designed to enrich the reader’s experience and accessibility to the content. For instance, the inclusion of Text-to-Speech functionality allows readers to listen to the book being read aloud, catering to individuals who prefer auditory learning or those with visual impairments. Moreover, the Screen Reader support ensures that the book is accessible to a wider audience, including those who rely on screen readers for consuming written content, thus promoting inclusivity and diversity in readership.

Additionally, the Enhanced Typesetting feature in “The Black Tax” optimizes the layout and formatting of the text, providing a seamless reading experience across different devices. This feature not only enhances readability but also ensures that the content appears visually appealing and well-structured, allowing readers to focus on the message without distractions. Furthermore, the Word Wise functionality offers valuable insights and definitions for complex terms or phrases, aiding readers in better understanding the intricate concepts discussed in the book. Lastly, the availability of Sticky Notes on Kindle Scribe enables readers to jot down thoughts, ideas, or reflections as they engage with the content, fostering a more interactive and personalized reading experience.

Pros

- Meticulously researched.

- Chronicles the impact of tax policies on racial wealth gaps.

- Offers a new perspective on tax policy debates.

- Timely exploration of racial injustices in taxation.

- Documents the systematic exploitation of Black homeowners.

Cons

- May contain complex political and economic concepts.

- Focuses on distressing historical and contemporary racial disparities.

Reviews

“The Black Tax” has garnered significant praise from renowned scholars and experts in the field. George Lipsitz, a prominent American studies scholar, commended the book for shedding light on the historical and contemporary impact of tax policies on racial disparities. Lipsitz emphasized the book’s meticulous research and its ability to offer a fresh perspective on the ongoing debates surrounding tax policy and racial inequality. Furthermore, Dorothy Brown, a distinguished tax law scholar, applauded the author’s approach in documenting the systematic exploitation of Black homeowners and the implications for wealth gaps.

In addition, N. D. B. Connolly, a history professor specializing in race and capitalism, highlighted the book’s critical examination of how state and local tax policies have perpetuated the Black-white wealth gap in America. Connolly underscored the importance of “The Black Tax” in challenging long-standing American myths about homeownership and exposing the predatory nature of racial capitalism. Moreover, William Sturkey, a historian focusing on the American South, praised the book for its in-depth analysis of the exploitation of Black homeowners from the Jim Crow era to present-day implications, illustrating how these practices have subsidized white communities and perpetuated racial injustices. Matt Lassiter, an expert in urban history, lauded the book for its timely exploration of racial injustices in taxation and its call for reparations as a means of rectifying historical wrongs and addressing contemporary disparities.

Images

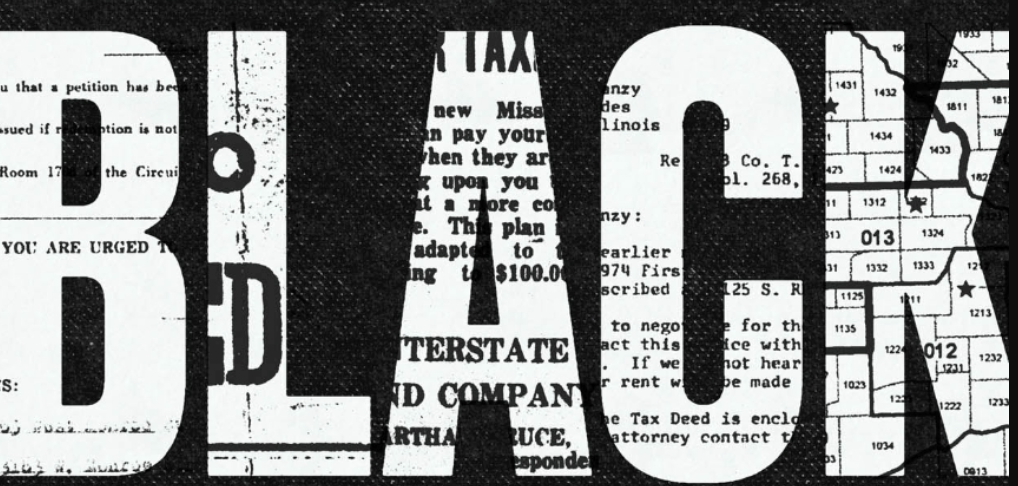

The cover image of “The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America” features a powerful visual representation that deeply resonates with the book’s theme. The cover art showcases a juxtaposition of symbols and imagery that encapsulate the essence of the Black Tax. In the foreground, a silhouette of a Black family stands solemnly, symbolizing generations affected by systemic exploitation and dispossession. The image is poignant, evoking a sense of resilience and struggle against racial injustices perpetuated through taxation policies over the years.

Moreover, the background of the cover art portrays a stark contrast between affluent white neighborhoods and marginalized Black communities, emphasizing the racial disparities embedded in tax systems. The visual narrative is compelling, as it vividly illustrates the unequal treatment and economic burdens shouldered by Black Americans throughout history. By incorporating these elements, the cover image serves as a thought-provoking visual entry point into the profound exploration of racial injustice and inequality presented in the book. It encapsulates the essence of the Black Tax and sets the tone for a critical examination of the historical and contemporary impacts of exploitative tax policies on Black lives in America.

Price Comparison

Compare the discounted price of $29.92 with the regular price of $34.99, highlighting the savings and percentage discount.

Recap the significance of “The Black Tax” in addressing racial injustices, reiterating the book’s impact on understanding historical and contemporary issues, and encourage readers to explore the book for a deeper insight into racial disparities in taxation.

The Black Tax: 150 Years of Theft, Exploitation, and Dispossession in America

Brought To You Buy…

George Fraser’s PowerNetworking Conference https://t.ly/6N6it | BlackTraumaGPT.com http://blacktraumagpt.com/ | MyGuardianDoc™ https://bit.ly/3TlgPaE – Your One-Stop for On-Demand Compassionate Medical Guidance, Urgent Care, Primary Care, and Virtual Second Opinions, all provided by licensed Medical Doctors.

Enjoy our content? Become a member of our Patreon https://www.patreon.com/revshock or support our 1st Frequency of Oneness Research Fund https://bit.ly/42lr54b

Socials:

SOLO: https://solo.to/revshock | BIO: https://t.ly/Ko_y_ | BLOG: https://t.ly/j6bh0 | PODCAST: https://t.ly/cB5GD | ENDORSEMENT: https://t.ly/jFErO | THREADS: https://t.ly/SoKkT | GRAM: https://t.ly/XsN8f | FB: https://t.ly/R3r9Y | TWITTER: https://t.ly/iJ-wy | LINKEDIN: https://t.ly/GZ0pe | TIKTOK: https://t.ly/zfp60